- Home

- Case Studies

- FinTech

How cloud telephony helped this bank make stronger & better bonds

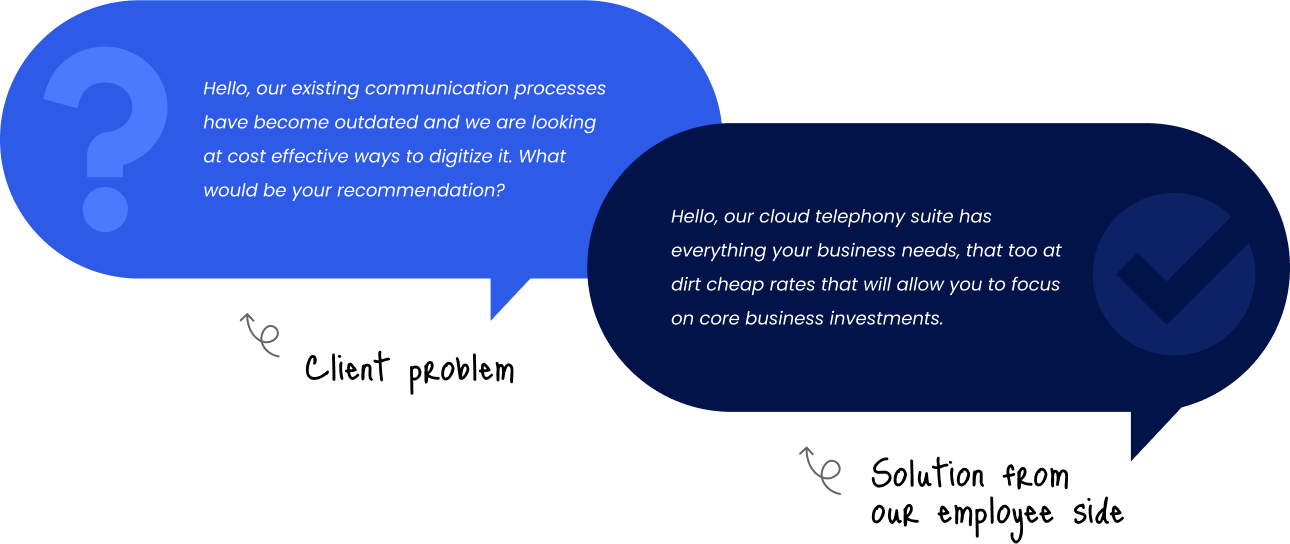

The increasing ease of navigating digital spaces has prompted banks and other financial institutions to simplify the process of managing money. This is made possible through the use of financial technology (FinTech). FinTech as an industry, encompasses various information systems and tools for carrying out financial services and transactions.

Servetel provides a range of services to our banking and finance clients. These are at their core, a professional phone system that requires no costly investment in hardware or infrastructure. Our cloud-based services are flexible and can be easily customized to adapt to changing requirements.

Understanding our Banking client's needs

Our client, one of India's biggest banks wanted to revamp their banking communication system. They wanted to make it more streamlined and user-friendly.

The fintech industry encompasses financial technology and banking technology involving financial services that utilize technology, innovation, and data. Banks are now utilizing these technologies to offer customers a seamless combination of traditional services. These involve services like loan provisioning, with modernized offerings like IVR-based customer support, cloud telephony, and mobile banking solutions.

Our client wanted to move towards a paperless and cashless future. They wanted to have the potential to increase efficiency rates and reduce operating costs in the long term.

FinTech initially gained traction in the market through banks, which gradually started offering their services and tools to customers online. As a result, people can now access banking services with just a stable internet connection, regardless of their location.

Our client wanted a virtual system that allowed their customers to access their accounts online without visiting the bank physically.

Boosting brand recognition with virtual numbers

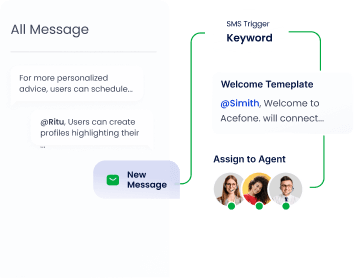

After understanding what the client required, we offered them a business phone number system with virtual numbers to help them enhance their customer services. We enabled them with advanced features such as call recording, call management suite, number masking, voicemail transcription, etc.

With our virtual numbers, they were able to set up support helplines for customers to call from anywhere in the country. Those numbers also made it easy for customers to recognise their brand, which ultimately created a good first impression in the market.

Personalized features for Business Phone Numbers

Call Management

Suite

Our all-in-one call management suite allowed their support team to manage all calling and day-to-day operations.

Interactive Voice

Response

An IVR is an in-call menu that helped our client's customers navigate themselves to the right department using the menu options faster than before.

Call

Reports

The cloud solution recorded all agent-customer interactions, which were sent to the supervisors via email reports to track overall performance.

Multi-Device

Compatibility

Remote teams could access their data by logging into the cloud through their personal devices from any part of the world.

Call

Routing

An intuitive feature that helped agents ensure each call went to the best-qualified department or agent based on their skills.

Free SMS

Alerts

Agents would receive SMS alerts every time they missed a customer call to ensure maximum client engagement along with maximum growth.

Intuitive

Dashboard

An easy-to-use and highly efficient dashboard with a simple and intuitive interface that anyone could use.

Number

Porting

Our client was able to expand their customer base while staying connected with their loyal customers through number porting.

CRM

Integrations

Our client was able to connect their cloud solution with their favorite CRM platforms to meet their specific needs.

Call

Recording

Call recordings helped our client's support team identify areas where improvements could be made and train employees accordingly.

Have Questions?

Upgrade your phone system to the cloud and avail amazing benefits.

How the automobile reseller benefitted from Business Phone Numbers

The virtual numbers we provided offered several benefits for the automobile reseller’s customer support, including:

Professionalism

Business phone numbers helped the recently launched business to leave a lasting impression on customers. Having dedicated numbers for their business gave the impression of an established organization rather than a new one.

Improved customer service

Our client witnessed a significant improvement in their standards of customer service by implementing business phone numbers to their support campaigns. They could manage calls more efficiently and ensure that customers were connected to the right representative quickly.

Expanded Reach

Business phone numbers can be accessed from anywhere, letting the automobile business provide continuous support. They could assist clients in different regions, states, or even countries. With this solution, our client could build a nationwide customer care network.

Cost-effective

Business phone numbers are cheaper than traditional phone numbers, allowing businesses to reduce expenses while still providing high-quality services. It helped our client to provide high-quality services to a greater number of customers without hiring extra staff.

Call tracking and analysis

Business phone numbers allow businesses to monitor their calls, gaining valuable information about customer requirements and areas for improvement. By utilizing these insights, our clients made well-informed strategic choices that resulted in tangible enhancements to their services.

Flexibility

Business phone numbers allow businesses to customize their call routing and messaging to meet their customers' specific needs. It helped them ensure that they were always available to provide the support that their customers needed. Our client used this feature particularly well to optimize their call flows as per their customer needs.

Overall, business phone numbers helped the automobile businesses provide better customer service and improve other areas of operations. Some other changes they experienced were increased access, fewer expenses, faster connections with customers, and nonstop support.

If you're interested in improving your business communication solution

You're at the start of something special.

Explore our cloud telephony solutions today.