When the 56th GST Council meeting concluded on September 3, 2025, multiple Indian business leaders sat glued to their television screens. They hoped their phone bills would finally see relief. The reality? GST on telecom services remains firmly at 18%, unchanged despite the government’s ambitious GST 2.0 reforms.

If you are a CPaaS provider or a UCaaS platform serving Indian businesses, this means navigating a transformed compliance landscape. Here’s what actually changed, what it means for your business, and how to adapt.

Current Scenario of Telecom Sector

The transformation of India’s telecom revolution began with the modernization of public networks in the 1980s. The government set up the Centre for Development of Telematics (C-DOT) in August 1984 to design indigenous digital switching systems.

Liberalization provided the real ignition. The 1999 National Telecom Policy shifted the sector from high fixed license fees to a revenue-share regime. This stabilized operators and accelerated rollout.

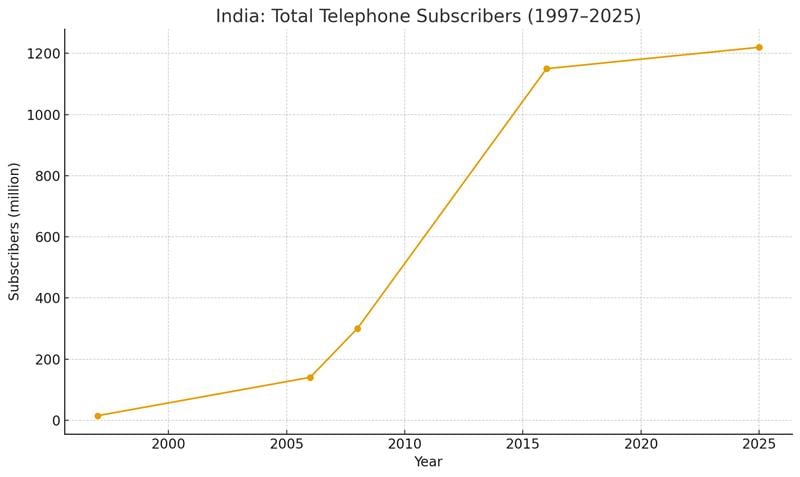

Within a decade, teledensity leapt from 2.32% in March 1999 to 62.51% by October 2010. The subscriber base surged from 14.88 million in 1997 to 300.49 million in March 2008. By March 2006, India had already crossed 140.32 million users, a steep climb captured in the chart below.

By mid-2025 the market’s scale and structure looked like this:

- 1,171.91 million wireless subscribers (including 5G FWA)

- 48.11 million wireline users, for a total of 1,220.02 million connections.

Overall teledensity stood at 86.15%, with 125.74% in urban India and 59.19% in rural areas. These figures frame both the achievement and the remaining inclusion gap.

What Does GST 2.0 Actually Include?

The next-generation reforms implemented under GST 2.0 have simplified tax slabs to 5%, 18%, and 40%. The Council has simplified the structure into a 5% slab for essentials, 18% for standard goods, and 40% for luxury/sin items, replacing the earlier complex categories.

The Big Picture Numbers:

- 78% of all goods now fall under the 5% slab, down from previous higher categories

- Electronics saw major relief with items like TVs moving from 28% to 18%

The changes have become effective from September 22, 2025.

Elaborating upon the new regime, India’s finance minister Nirmala Sitharaman called GST 2.0 a “system cleaning reform.” She said that “These reforms have a multi-sectoral and multi-thematic focus, aimed at ensuring ease of living for all citizens and ease of doing business for all.”

Telecom’s GST Status

The new regime impacted a wide variety of goods and services, leaving out a few. The verdict for telecom? Services have remained largely untouched by rate reductions. Here is the transformation in a nutshell:

Zero Direct Relief

Despite widespread speculation about potential rate cuts, GST on telecom services maintained its 18% rate. This affects:

- Mobile voice calls and SMS

- Data services and broadband

- Value-added services

- Roaming charges

- Enterprise telecom solutions

Why no change? The GST Council focused its rate rationalization efforts on goods that could provide immediate relief to final consumers. Telecom services, generating approximately ₹3.36 trillion in annual revenue, remain a crucial tax revenue source for the government.

What Changed Behind the Scenes?

While consumer bills saw no direct GST relief, you as telecom operators, might face significant operational changes:

1. Place of Supply Rules for Intermediary Services

New Rule: Place of supply for intermediary services shifted to the recipient’s location.

Impact for Telecom:

- India-based aggregators and resellers can now qualify more services as zero-rated exports

- International Application-to-Person messaging services, i.e.. text messages sent from a business application or platform to a person in another country benefit significantly

- Carrier service brokering sees improved margins

Example: A Mumbai-based CPaaS provider routing international SMS traffic can now treat more transactions as exports, reducing domestic GST liability from 18% to 0%.

2. E-Invoicing Compliance Gets Stricter

Critical Deadline: Companies with Annual Aggregate Turnover (AATO) ≥ ₹10 crore must upload e-invoices within 30 days to the Invoice Registration Portal (IRP).

What this means for telecom operators:

- Time to upgrade billing systems, delays won’t cut it anymore

- You’ll need real-time compliance tracking to stay on top of the rule

- Miss the 30-day window? Your invoice could be rejected, impacting GST credit and reporting

3. GSTAT Is Now Live for Dispute Resolution

The GST Appellate Tribunal (GSTAT) is officially up and running and has started accepting appeals. Hearings are expected to begin in December 2025.

Why this matters for telecom:

- Faster resolution for prepaid voucher valuation issues

- Clarity on how to classify roaming and interconnect charges

- A more streamlined way to handle discount and commission disputes

It’s a welcome move, finally, a clear path to resolve long-standing tax ambiguities.

4. Input Tax Credit

The GST rate on telecom services remains unchanged at 18%. However, the changes in GST rates on goods have opened some real opportunities to optimize your ITC strategy.

Equipment & Infrastructure

- Most network hardware still attracts 18% GST

- Some peripheral equipment may now fall under lower-rate slabs, time for a classification review

- Bundled device + service plans might need re-evaluation under the updated HSN codes

Consumer Electronics Boost

GST cuts on items like TVs, appliances, and gadgets could fuel higher consumer spending. That translates into more data usage, an indirect win for telecom operators.

Adaptation Over Expectation

GST 2.0 brought significant tax relief for goods, but telecom services were left untouched at 18%. So instead of waiting for a rate cut that might never come, your focus can now shift to:

- Strengthening compliance systems

- Finding new ITC optimization opportunities

- Reworking export and intermediary service strategies

- Reviewing equipment classifications and procurement plans

As GST reshapes telecom operations and compliance, ensure your customer engagement evolves too. Explore how a strong customer experience strategy can help your telecom business stay compliant while delivering exceptional service

Key Takeaways for Telecom Operators

- No GST reduction on consumer bills

- Compliance requirements are getting tighter

- Export and cross-border service opportunities are growing

- Equipment procurement and bundling strategies need fresh analysis

What Success Looks Like

The telecom companies that move fast, embrace the new compliance landscape, and rework their tax strategies will be in a stronger position. Those still waiting for rate cuts may fall behind.

In this new phase of GST, agility beats expectation.

Want to stay compliant and efficient under the new GST regime? Explore how BPO call center software can help streamline operations and reduce cost burdens.

FAQs

Telecommunication services continue to attract 18% GST under the GST 2.0 regime. There are no sector-specific rates announced for the telecom industry. Roaming is treated as any other telecommunication services and taxed at 18% like regular mobile services. Place-of-supply follows the telecom rules in the IGST Act (see Q5 for PoS). Not specifically from GST 2.0. The telecom GST rate remains 18%. Other sectoral cuts may lift consumption, but do not directly lower telecom GST. The GST Appellate Tribunal (GSTAT) has been formally launched; hearings are slated to begin December 2025, enabling sector disputes (prepaid valuation, discounts/commission chains, PoS controversies) to move faster. From July 2025, auto-populated outward liability in GSTR-3B is hard-locked and non-editable. The corrections must flow via GSTR-1/GSTR-1A before you file 3B. Tighten your R1↔IRN↔3B reconciliations and vendor nudges.